purplerat wrote:crank wrote:purplerat wrote:crank wrote:This is the problem, you don't distinguish between what is legal because of legitimate concerns and what is legal because politicians are bought. It means you have no problem with some of the biggest corporations paying zero taxes.

I didn't say I have "no problem" with it. I do think the tax code should be changed. But until it is I'm not going to demonize those who don't pay more taxes than they have to.

And the whole "biggest corporations" thing is largely a red herring. The bulk of the tax reform needs to take place in the middle but most aren't willing to tell people in the middle that they have to pay more so it's a non-starter. If you think otherwise can you point me to any large scale model where the average person is paying less in personal income tax than in the US but social services are much better because big corporations are paying so much more?

I said you have that problem, and I still do. If you're worried about people cheating, then allowing big corporations and the richest people avenues to pay less or none, is a fantastic source for anyone to rationalize cheating. I do agree the tax code is insane, it should probably be scrapped and go with a wealth tax.

I don't believe for one second that somebody who cheats on their taxes would be dissuaded from doing so if "big corporations" paid more in taxes. The reality is that the big corps already pay way more in taxes than most people so it's a bullshit excuse to begin with. If people can get away with it they will regardless of what excuses are most convenient.

Wow, you mean big corporations earning billions of dollars pay more taxes than most people? Stop the presses! FFS, what is your point? You're not thinking clearly if you believe that constantly hearing about the big corporations that pay

zero taxes isn't going to push some people over the edge into evading taxes.

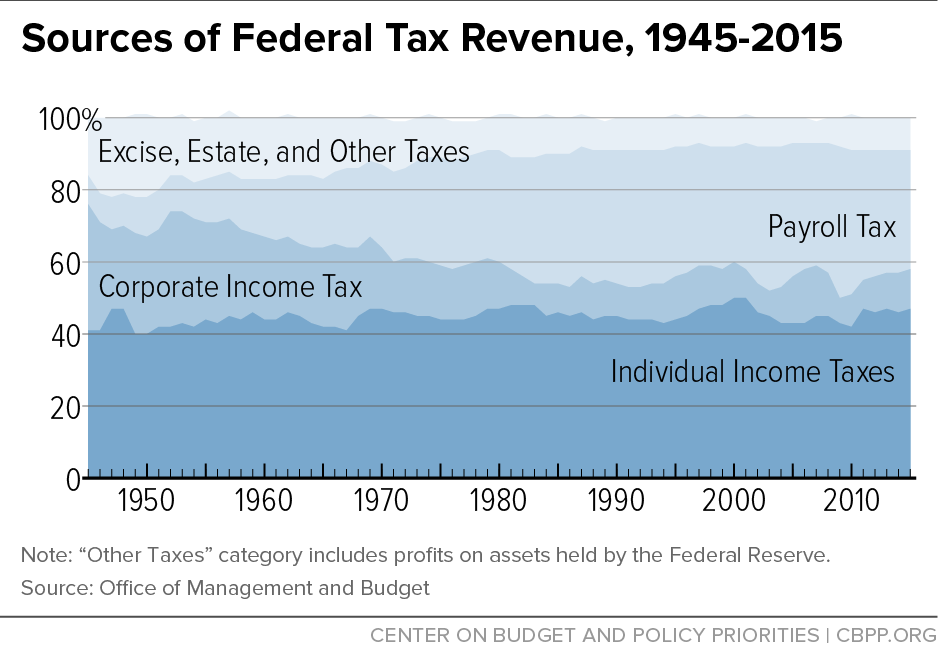

This is the breakdown of where tax receipts come from, as can be seen, the share paid by corporations has declined signficantly since the 50's, from

The Sorry State of Corporate Taxes.

It goes on to say, highlights mine:

EXECUTIVE SUMMARY

Back to Contents

Profitable corporations are supposed to pay a 35 percent federal income tax rate on their U.S. profits. But many corporations pay far less, or nothing at all, because of the many tax loopholes and special breaks they enjoy. This report documents just how successful many Fortune 500 corporations have been at using these loopholes and special breaks over the past five years.

The report looks at the profits and U.S. federal income taxes of the 288 Fortune 500 companies that have been consistently profitable in each of the five years between 2008 and 2012, excluding companies that experienced even one unprofitable year during this period. Most of these companies were included in our November 2011 report, Corporate Taxpayers and Corporate Tax Dodgers, which looked at the years 2008 through 2010. Our new report is broader, in that it includes companies, such as Facebook, that have entered the Fortune 500 since 2011, and narrower, in that it excludes some companies that were profitable during 2008 to 2010 but lost money in 2011 or 2012.

Some Key Findings:

• As a group, the 288 corporations examined paid an effective federal income tax rate of just 19.4 percent over the five-year period — far less than the statutory 35 percent tax rate.

• Twenty-six of the corporations, including Boeing, General Electric, Priceline.com and Verizon, paid no federal income tax at all over the five year period. A third of the corporations (93) paid an effective tax rate of less than ten percent over that period.

• Of those corporations in our sample with significant offshore profits, two thirds paid higher corporate tax rates to foreign governments where they operate than they paid in the U.S. on their U.S. profits.

These findings refute the prevailing view inside the Washington, D.C. Beltway that America’s corporate income tax is more burdensome than the corporate income taxes levied by other countries, and that this purported (but false) excess burden somehow makes the U.S. “uncompetitive.”

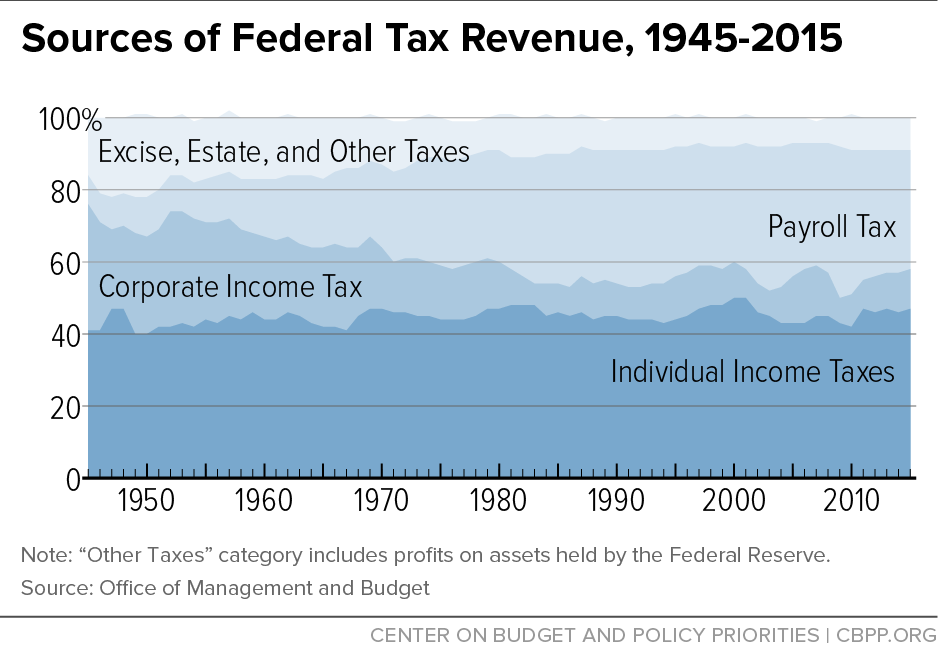

Indivduals' breakdown of tax rates, from

here:

Can you show me how you get the idea " that the big corps already pay way more in taxes than most people "? By what metric do you get this idea?

“When you're born into this world, you're given a ticket to the freak show. If you're born in America you get a front row seat.”

-George Carlin, who died 2008. Ha, now we have human centipedes running the place